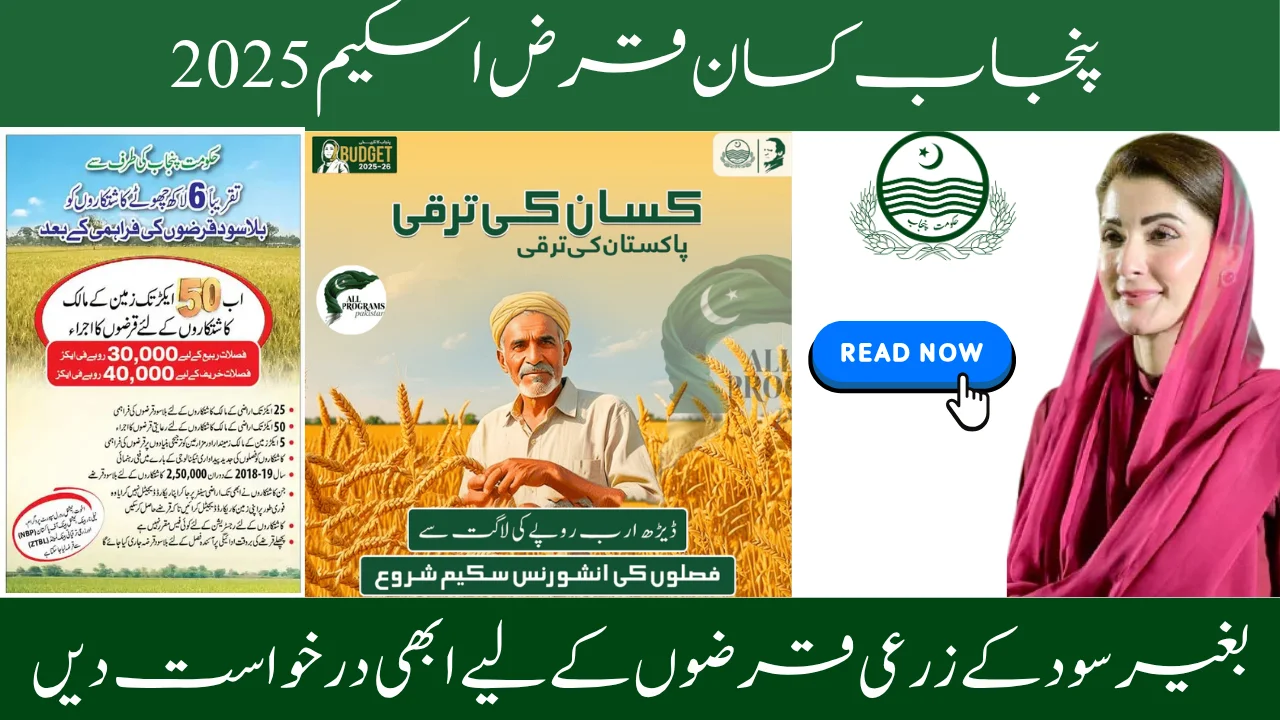

Punjab Farmers Loan Scheme – Apply now for zero-interest Agricultural Loans

The Punjab Farmers Loan Scheme 2025 has been described by Chief Minister Maryam Nawaz as one of the most ambitious agriculture financing programs. It is, therefore, to further encourage farmers that the Government of Punjab decided to provide zero-interest loans for small and medium-sized farmers. Read About the Punjab Farmers Loan Scheme – Apply now for zero-interest Agricultural Loans.

The small farmer is the backbone of the agricultural economy of Pakistan. However, they are always battling through the vicissitudes of limited resources, high fertilizer prices, and increased fuel costs. Therefore, the Punjab Government came up with the Interest-Free Agricultural Loan 2025 scheme to give a hand to the farmers. This program ensures that all eligible farmers can access up to Rs. 40,000 an acre with no interest.

Read More: Punjab Government Launches Rs 3 Crore Tractor Subsidy Scheme 2025

Punjab Farmers Loan Scheme:

The Punjab Farmers Loan Scheme is a significant step towards the modernization of agriculture and the upliftment of rural areas. The program gives no-interest credit to the farmers, which helps them to purchase easily the necessary implements, seeds, and fertilizers.

Key Objectives

- Give no-interest loans for small and medium farmers.

- Increase crop yields and productivity.

- Promote digital loans via banks.

- Reduce your dependence on informal or private lenders.

- Support sustainable agricultural practices and rural development.

- Encourage inclusion in the financial system and transparency by government monitoring.

- Strengthen Pakistan’s agricultural base and enhance food safety.

Loan Amount and Financial Details:

Punjab Government initiative offers a Direct Interest-Free Loan based on the type of crop cultivated.

| Crop type | Loan Amount in Pakistani Rupees per Acre | Repayment Period |

| Rabi Crops (Wheat, Barley, etc.) | Rs.30,000 | 6-8 Months |

| Kharif Crops (Rice, Cotton, Maize, etc.) | Rs.40,000 | 6-8 Months |

All loans are free of interest, and repayment is after harvest.

The loan distribution is done electronically via ZTBL and NBP.

Read More: CM Punjab’s High-Tech Mechanization Program for Silage Harvesters 2025

Eligibility Criteria for Punjab Farmers Loan Scheme 2025:

In order to qualify for the Zero Interest Agricultural Loan, the farmer must meet the following requirements.

- You must be a Punjab resident.

- You can own or lease land up to 50 acres.

- You must be registered with the Punjab Agriculture Department.

- You should have a valid Computerized National Identity Card.

- A mobile SIM card must be registered with its CNIC.

- There should be no defaults on commercial bank loans.

- Tenant farmers who have verified land records are also eligible.

Required Documents

Before applying, farmers must prepare the following documents.

- Copy of CNIC

- Land Ownership Proof (Registration / Fard)

- mobile number registered with CNIC

- Passport-sized photographs

- Bank account details (NBP / ZTBL)

Application Process – Step-by-Step Guide:

The application process for the Punjab Farmers Loan Scheme 2025 can be done in a digital, transparent, and simple way.

- SMS registration: To register, send your CNIC by SMS to 8070.

- Verification: The system verifies that you have a valid CNIC number and can prove your land ownership by the Punjab Land Record Authority.

- Visit Bank: Take your documents to the nearest NBP branch or ZTBL branch.

- Form Submission: Complete the official loan application and attach all required documents.

- Approval After verification, your application is approved by the bank.

- Transfer of funds: Your account will receive the approved loan amount via digital transfer.

- Repayment: Pay back the loan after harvest. No interest will be charged

Read More: Punjab Kisan Card 2025 Bill Payment Phase Begins – Win Rewards

Partner Banks for Disbursement:

The Punjab Government has partnered with major agricultural banks to ensure the smooth operation of the program.

| Bank name | Service Provided |

| National Bank of Pakistan | Registration and Loan Issue |

| Zarai Taraqiati Bank Limited (ZTBL) | Agricultural Financing |

| Bank of Punjab (BOP), | Digital Payment Management |

These banks provide full transparency, digital processing, and rapid access to funds.

Benefits of the Punjab Farmers Loan Scheme 2025:

Punjab’s small-scale farmers can benefit from the program in multiple ways:

- Zero Interest Loans: There is no markup and no burden for the farmers. They only pay back the principal amount.

- Financial Aid: Eliminates dependence on informal lenders who charge high interest rates.

- Crop improvement: Allows the purchase of quality seeds, fertilizer, and machinery.

- Women & Youth empowerment: Inclusive Opportunities for Women and Young Farmers.

- Economic growth: Boosts Punjab’s agricultural productivity as well as GDP contribution.

- Transparency Digital Verification reduces corruption and ensures fair distribution.

- Sustainability promotes eco-friendly, intelligent, and modern farming methods

Important Dates Tentative 2025:

| Event | Date (Expected |

| Launch of the Scheme | January 2025 |

| Online/SMS registration opens | February 2025 |

| Application Deadline | 15 October 2025 |

| The loan disbursement starts | November 2025 |

Target Beneficiaries

The Punjab Farmers Loan Scheme for 2025 will benefit more than 600,00 small and medium farmers. The scheme is open to farmers who cultivate:

- Wheat

- The Rice Industry

- Sugarcane

- Cotton

- Maize

- Oilseed Crops

Future expansions could also include the dairy and livestock sectors, to ensure that all rural households benefit equally from Punjab’s agricultural development plan.

Government’s Vision Behind the Scheme:

The Government of Punjab envisions a prosperous agricultural economy, where each farmer has equal access to credit and technologyMaryam Nawaz Sharif, the Chief Minister, is pivoted on the concept of new, transparent, and digitalized agricultural schemes that will directly benefit the farmers. The Punjab Farmers Loan Scheme 2025 happens to be part of the Punjab Agriculture Transformation Plan, including fertilizer subsidies and solar tube-well projects. The whole idea is to build up an all-in, modern, and sustainable farming ecosystem in the province through the collaboration of all these measures.

Conclusion

The Punjab Farmers Loan Scheme heralds rural prosperity and agricultural renewal. By providing interest-free loans, the Punjab Government abolished one of the major barriers that the small farmers faced—affordable finance access.

The program uses digital processing, verifiable documentation, and partnerships with banks to ensure that every rupee goes directly to the farmers. Transparency builds trust and encourages farmers to register. It also strengthens the agricultural ecosystem.

This scheme is also a perfect match for the long-term vision of Punjab agriculture: it enhances sustainability, inclusiveness, and technological advancement. Farmers will not only be able to improve their yields and implement modern technologies but also contribute to the economic growth of Pakistan without the financial stress haunting them.

FAQs

Who can apply for the program?

The Punjab Agriculture Department will register farmers who own or lease up to 50 acres of land.

How much money is disbursed as a loan?

The funds are transferred electronically to the registered account of the farmer.

Is the loan interest-free?

The farmer will pay only the principal.

What are the procedures to avail of the scheme?

Just send your CNIC through SMS to 8070 or just visit any ZTBL/ NBP branch near you.

Which papers are required?

CNIC, Land documents, photographs, contact numbers, and bank account numbers.